The Ultimate CPF Contribution Guide 2021

Seeing a chunk of your monthly salary goes to CPF every month? Do you ever wonder how things are going with that chunk and how it will benefit you? Or are you one of those workers that simply follow the rules to contribute and have a retirement nest egg in the future? Then, now is the time to learn more about the CPF contribution in Singapore.

Here is the ultimate CPF guide you must know for 2021.

-

- What is Central Provident Fund in Singapore

- Why do we have a CPF Account?

- The Process of CPF Contributions

- The CPF contribution rates for Singaporean employees/employers

- The CPF contribution capping for employees

- The different CPF accounts

- The monthly CPF allocation rates for the accounts

- Utilization of Money in the CPF accounts

- The CPF Retirement Sum

- The CPF Interest Rate

- Common Frequently Asked Questions about CPF

- Revision in CPF contribution rates from 1 January 2022

What is Central Provident Fund in Singapore

According to the Central Provident fund board, the central provident fund (CPF) is a comprehensive social security system that enables working Singapore Citizens and Permanent Residents to set aside funds to meet financial needs. Aside from retirement, CPF’s primary purpose is to help Singaporeans save for healthcare, homeownership, family protection, and asset enhancement.

Why do we have a CPF Account?

The CPF requires all working Singaporeans earning more than S$500 per month to make regular contributions to the Fund through an employment-based savings scheme for their benefit. The employer will deposit the regular and compulsory CPF contribution of the employee to the CPF.

For self-employed individuals, the CPF contributions are voluntary except the Medisave contributions. CPF requires that contributions be paid after filing of taxes.

The Process of CPF Contributions

As the employee turns 55, he will have four CPF if terms and conditions are met. At first, the Retirement Account will be funded by the amount in the Special Account. After that, the Ordinary Account will be used when it hits a certain predetermined “Full Retirement Sum (FRS). Other payments aside from basic wages such as commissions, cash incentives, and bonuses also attract CPF contributions. CPF contribution does not require Senior citizens and SPR working overseas to contribute.

The CPF contribution rates for Singaporean employees/employers

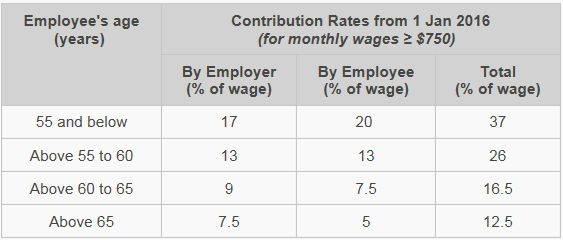

The CPF contribution rates vary according to the age bands, which slowly reduce from age 55 onwards. Employers are also required to make a separate contribution to the employee’s CPF account.

The CPF contribution rates of the members depend on their citizenship status, age group, and the total wages for the calendar month.

The CPF contribution capping for employees

The CPF contribution cap is known as the CPF Wage Ceiling, which can be the Ordinary Wage Ceiling and the Additional Wage Ceiling. The Ordinary Wage Ceiling is based on the monthly salary and is currently capped at $6,000. The first $6,000 is subject to CPF contributions from both employee and employer.

The Additional Wage Ceiling pertains to the other payments received aside from the basic wages, such as bonuses and allowances. Additional Wage Ceiling is capped at $102,000 – Additional Wages subject to CPF for the year.

The different CPF accounts

The following are different CPF accounts for all Singaporeans and PRs.

- Ordinary Account (OA) - It is used for housing, higher education, and investing. Any leftover is to be used for retirement. At age 35 and below, most of the contributions are allocated in this account to support the home purchase. Due to the presumption, the members of this age group are more likely to buy a house and less likely to fall seriously ill.

- Special Account (SA) - It is saved for retirement and can also be used for investing to a certain degree. As the member gets older, more money is allocated to this account to prepare for retirement.

- Medisave Account (MA) - This account is used for hospitalization and other approved medical expenses. At age 65 and above, the contributions are mainly allocated to this account to maintain the Basic Healthcare Sum for any medical expenses.

- Retirement Account (RA) - This account is only available when a member turns 55. The Ordinary and Special Account are merged to form the Retirement Account.

The monthly CPF allocation rates for the accounts

The monthly CPF contribution is allocated to different accounts concerning the member’s age group and the employee type.

Utilization of Money in the CPF accounts

There are no rules in the utilization of CPF accounts before the retirement age. However, Singaporeans have common ways to use the money in their accounts.

The money in the Ordinary Accounts can purchase a house, subject to withdrawal limits and the compulsory cash portion that members must pay. It can also be used to make monthly home loan repayments. Members are also eligible to get a CPF Housing Grant and CPF Education Scheme upon meeting specific criteria.

For investment purposes, the Ordinary and Special Accounts are used through the CPF Investment Scheme. Investments can be through shares, Unit Trusts, investment-linked insurance, Singapore Government Bonds, and ETFs.

The Medisave CPF Account can also buy an Integrated Shield plan, private health insurance plans to boost the MediShield Life.

The CPF Retirement Sum

Basically, two main retirement payout programs are available - the older CPF Retirement Sum Scheme and the newer CPF LIFE (Lifelong Income For The Elderly) scheme. The older one requires a member to have a minimum amount in the account to ensure monthly payouts to support a basic living standard. The higher the amount in the Retirement Account means a higher monthly payout. The newer scheme provides a monthly payout for the member for the rest of his life but subject to terms and conditions. The monthly payout can start between the ages of 65 and 70.

The CPF Interest Rate

The CPF Interest Rate may be complicated, but it is essential to know how much your CPF accounts earn. Take a look at the table below.

| Account | Interest rate (per annum) |

| OA | Up to 3.5% |

| SA | Up to 5% |

| MA | Up to 5% |

| RA | Up to 6% |

The ordinary account earns up to 3.5% per annum. However, it only applies to the first S$ 20,000, and the succeeding amount makes 2.5% interest per annum.

Both the Special Account and Medisave Account earn up to 5% interest per annum. However, it applies when the combined balance is S$60,000 or below. After this amount, the SA and MA will earn 4% annually.

The Retirement Account has the highest earning capacity with its 6% interest per annum. The prevailing interest is 4% per annum, but you can get an extra 1% interest on the first S$60,000 of the combined balance. You can also get another additional 1% interest on the first S$30,000 of the combined balances if you are 55 years old or above. This account reflects the country’s economy because this is reviewed annually and in line with Singapore’s economic performance.

Common Frequently Asked Questions about CPF

How do I make CPF nominations?

When a person dies, the CPF contribution funds cannot be distributed through a Will. Therefore, you need to choose a person who will be the beneficiary of your CPF savings, and they can be anyone in your first family such as parents, spouse, kids, siblings, etc. It is referred to as a nomination. It also authorizes the CPF Board to disclose your information upon your death. Without a nomination, the intestacy laws of Singapore will determine who gets your CPF funds.

Making a CPF nomination can be done online and at your convenience at cpf.gov.sg. A valid SingPass is needed, and two witnesses with also their own valid Singpass are required.

What is the CPF Annual Limit?

The CPF Annual Limit determines the amount of money your CPF contribution account can receive each year. Currently, it is set at S$37,740, and it applies to both mandatory and voluntary contributions.

What are CPF Calculators?

If you are still unsure how the CPF contribution money works, you can refer to the CPF Calculators. There are many calculators available, and you can access them online, but the following are the most used CPF Calculators to make the job easier.

- CPF Contribution Calculator

- It is for Singapore citizens and Permanent Residents in their 3rd year and onwards. It computes the CPF contribution payable for private sector/ or non-pensionable government employees with updated interest rates effective from January 2016.

- CPF LIFE Payout Estimator

- If you’re at least 55 and 79, this tool can help you estimate how much you can receive in monthly retirement payouts.

- CPF Housing Limits Calculator This tool is designed to help you estimate the amount you can use for your housing property. If you buy properties before May 10, 2019, and with a remaining lease of at least 60 years, you can use this calculator.

- MediSave / MediShield Life Claims Calculator This tool is used to estimate the amount you can withdraw from the MediSave account. This is very important if there are claims concerning your health. It is applicable for claims with the admission date on or after Nov 1, 2015.

- CPF Retirement Calculator This calculator is a helpful tool to calculate if you are on track with your retirement goal. It is very much beneficial in financial planning you need based on the desired retirement age and lifestyle.

How will I contact CPF?

Getting in touch with CPF can be done in many ways. One way is to contact them through the MyCPF portal. Using your SingPass, you can access information about your CPF account, and you can submit queries in the mailbox. Another way is through submitting a web form with your inquiries. Another is the CPF hotline which is available from Monday to Friday from 8:00 am to 5:30 pm. Lastly, you can visit the office personally, but you need to make an appointment first. The CPF has Service Centres in Tanjong Pagar, Bishan, Tampines, Jurong, or Woodlands, but services for employers and self-employed are not available at these service centres.

Revision in CPF contribution rates from 1 January 2022.

From January 1, 2022, the CPF Contribution Rates for employees aged 56 to 70 and earning monthly wages of more than S$750 will increase to strengthen their retirement adequacy. As recommended by Tripartite Workgroup on Older Workers, the increase will be fully allocated to the Special Account to boost the retirement income. Please note that there is no change to the CPF contribution rates for other age groups.

The table below shows the Revision in CPF contribution rates that start from 1 January 2022.

Does Carbonate HR Solution calculate the CPF Contribution?

Yes, Carbonate calculates the CPF contribution for employees. We only need a few details to calculate the data. Carbonates have lots of features concerning the CPF contribution of members and provide seamless reports less the erroneous computation associated with manual spreadsheets.